Look At The Below Yield Curve Inversion Chart

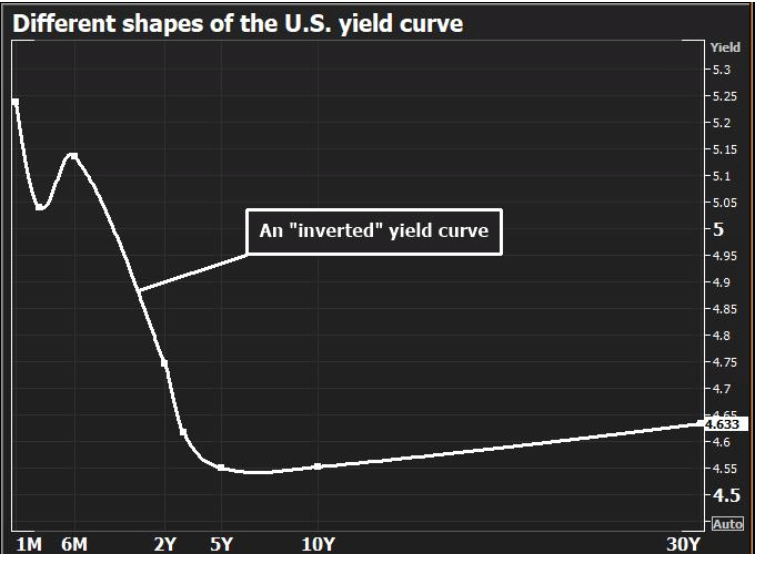

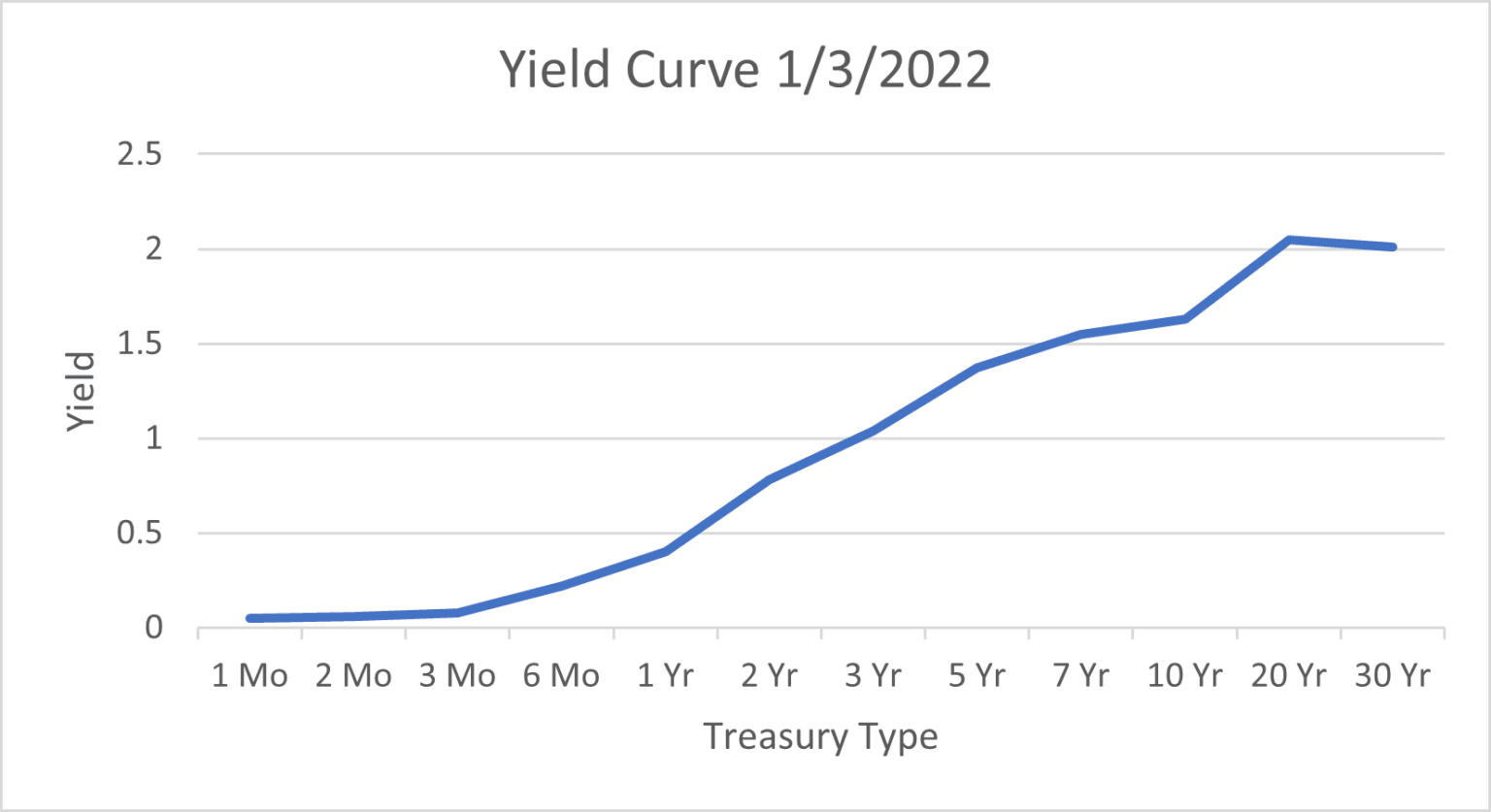

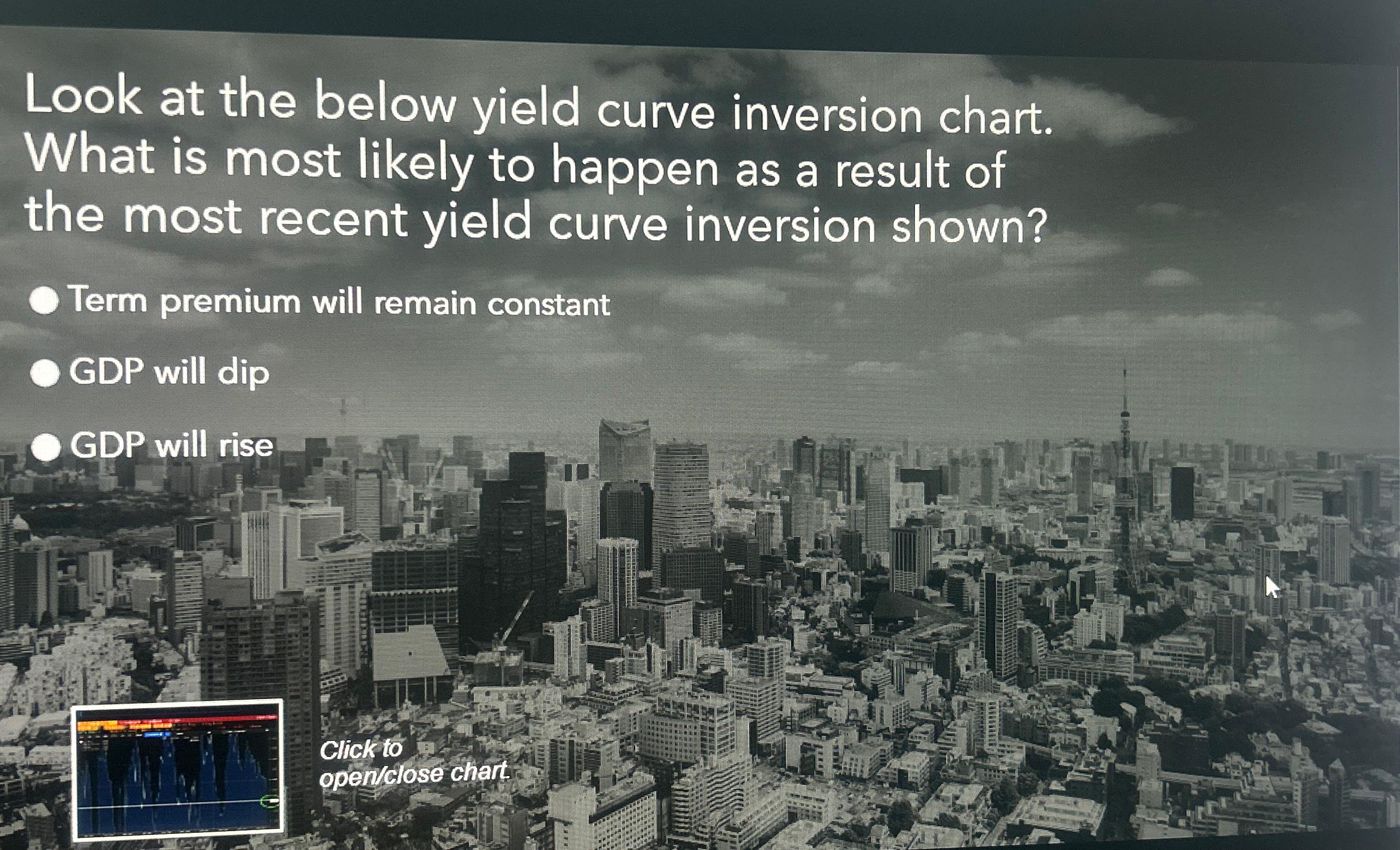

Look At The Below Yield Curve Inversion Chart - Positive values may imply future growth, negative values may imply economic downturns. Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; We look specifically at the difference in yield between treasuries maturing in. All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. Web an inverted treasury yield curve is typically seen as a harbinger of recession, although the u.s. At the same time, the weighted average interest rate has increased from 1.32% to 3.02%. Gdp will dip if the curve inversion is a sign of recession, we'd expect the gpd to go lower or negative. Web look at the below yield curve inversion chart. Gdp will rise gdp will dip term premium will rise. View the full answer answer. View the full answer answer. We typically look at u.s. Web this chart from the st. Web the longer yield curve indicative of the former with yesterday's bear steepening. Web a yield curve plots the interest rates of bonds that have equal credit quality but different maturity dates. This chart shows the nominal real yield curve. Inflation to the 2's of the tens and the curve is inverted. When they flip, or invert, it’s widely regarded as a bad. The yield falls off as the maturity date gets further away when the yield curve is inverted. Web what is the yield curve inversion chart? Web the table below shows that the current streak of inverted yield curves is the longest in the u.s. Inverted yield curves can be. Web the us treasury yield curve rates are updated at the end of each trading day. The yield falls off as the maturity date gets further away when the yield curve is inverted. It shows interest. This chart shows the nominal real yield curve. What is most likely to happen as a result of the most recent yield curve inversion shown? All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. With the tame cpi report, the odds of a september rate hike have risen to above 90%.. Gdp will dip if the curve inversion is a sign of recession, we'd expect the gpd to go lower or negative. Web what is the yield curve inversion chart? The three types are normal, inverted, and flat. With the tame cpi report, the odds of a september rate hike have risen to above 90%. This chart shows the nominal real. Web the yield curve is still inverted, but it's become significantly less inverted over the past several weeks. All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. Web so what does an inverted yield curve look like, and what does it signal about an economy? The yield falls off as the. We typically look at u.s. Knowledge check look at the below yield curve inversion chart. Inflation to the 2's of the tens and the curve is inverted. Treasury debt at different maturities at a given. Web the us treasury yield curve rates are updated at the end of each trading day. Positive values may imply future growth, negative values may imply economic downturns. Web the table below shows that the current streak of inverted yield curves is the longest in the u.s. Web the yield curve inversion suggests potential economic concern. Gdp will rise gdp will dip term premium will rise. We typically look at u.s. Web an inverted treasury yield curve is typically seen as a harbinger of recession, although the u.s. The gray bars throughout the charts indicate the past u.s. Web a yield curve illustrates the interest rates on bonds of increasing maturities. All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. It often. View the full answer answer. Web this chart from the st. What is most likely to happen as a result of the most recent yield curve inversion shown? Web the yield curve inversion suggests potential economic concern. We typically look at u.s. When they flip, or invert, it’s widely regarded as a bad. All data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. Inverted yield curves can be. The yield falls off as the maturity date gets further away when the yield curve is inverted. We look specifically at the difference in yield between. What is most likely to happen as a result of the most recent yield curve inversion shown? This chart shows the nominal real yield curve. The three types are normal, inverted, and flat. Web a yield curve illustrates the interest rates on bonds of increasing maturities. Web the yield curve inversion suggests potential economic concern. Web this chart from the st. What is most likely to happen as a result of the most recent yield curve inversion shown? Web here is a quick primer explaining what a steep, flat or inverted yield curve means and how it has in the past predicted recession, and what it might be signaling now. It often precedes economic downturn,. Inverted yield curves can be. The yield falls off as the maturity date gets further away when the yield curve is inverted. Web the us treasury yield curve rates are updated at the end of each trading day. Treasury debt at different maturities at a given. Inflation to the 2's of the tens and the curve is inverted. Web a yield curve plots the interest rates of bonds that have equal credit quality but different maturity dates. Web the longer yield curve indicative of the former with yesterday's bear steepening. Web the chart below shows the true danger of the recent drop in the overall maturity of the debt. After topping out at 6.24 years in 2023, the average weighted maturity of the debt is 5.91 years. The three types are normal, inverted, and flat. Web the yield curve inversion suggests potential economic concern. When they flip, or invert, it’s widely regarded as a bad.What is a Yield Curve Inversion and Why Does it Matter? ADM

Inverted Yield Curve Chart

The Yield Curve Is Inverted And It's Okay

Inverted Yield Curve Definition, What It Can Tell Investors, and Examples

Solved Look at the below yield curve inversion chart. What

OneClass Look at the below yield curve inversion chart. What is most

Solved Look at the below yield curve inversion chart. What

Solved Look at the below yield curve inversion chart. What

Look At The Below Yield Curve Inversion Chart

Trading 101 The inversion of the US Treasury yield curve

Here Is A Quick Primer On What An Inverted Yield Curve Means, How It Has Predicted Recession, And What It Might Be.

What Is Most Likely To Happen As A Result Of The Most Recent Yield Curve Inversion Shown?

Web An Inverted Treasury Yield Curve Is Typically Seen As A Harbinger Of Recession, Although The U.s.

The Gray Bars Throughout The Charts Indicate The Past U.s.

Related Post:

:max_bytes(150000):strip_icc()/InvertedYieldCurve2-d9c2792ee73047e0980f238d065630b8.png)

.1566418097341.png)