Sp 500 Chart Remains Negative Despite Oversold Conditions

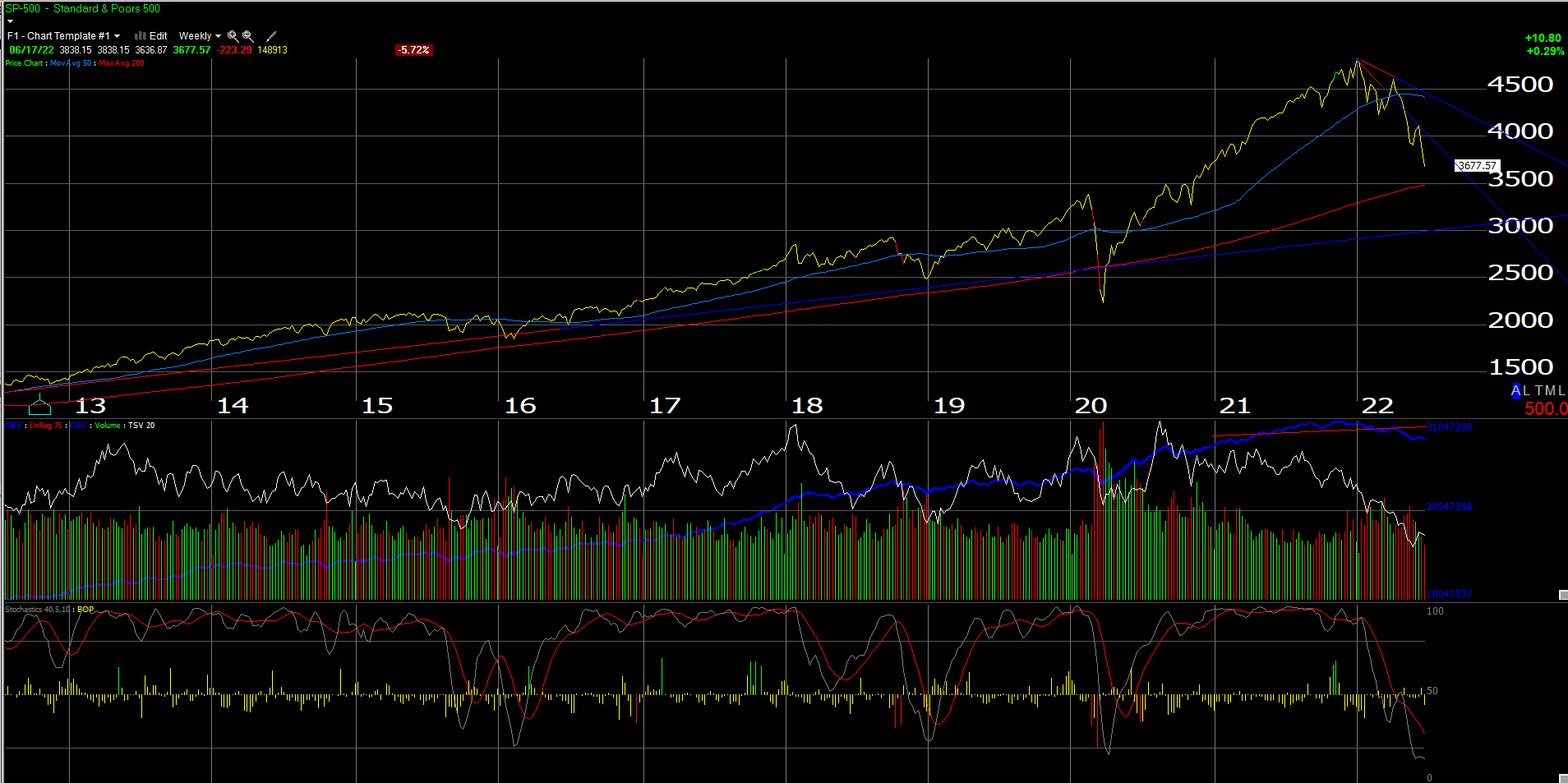

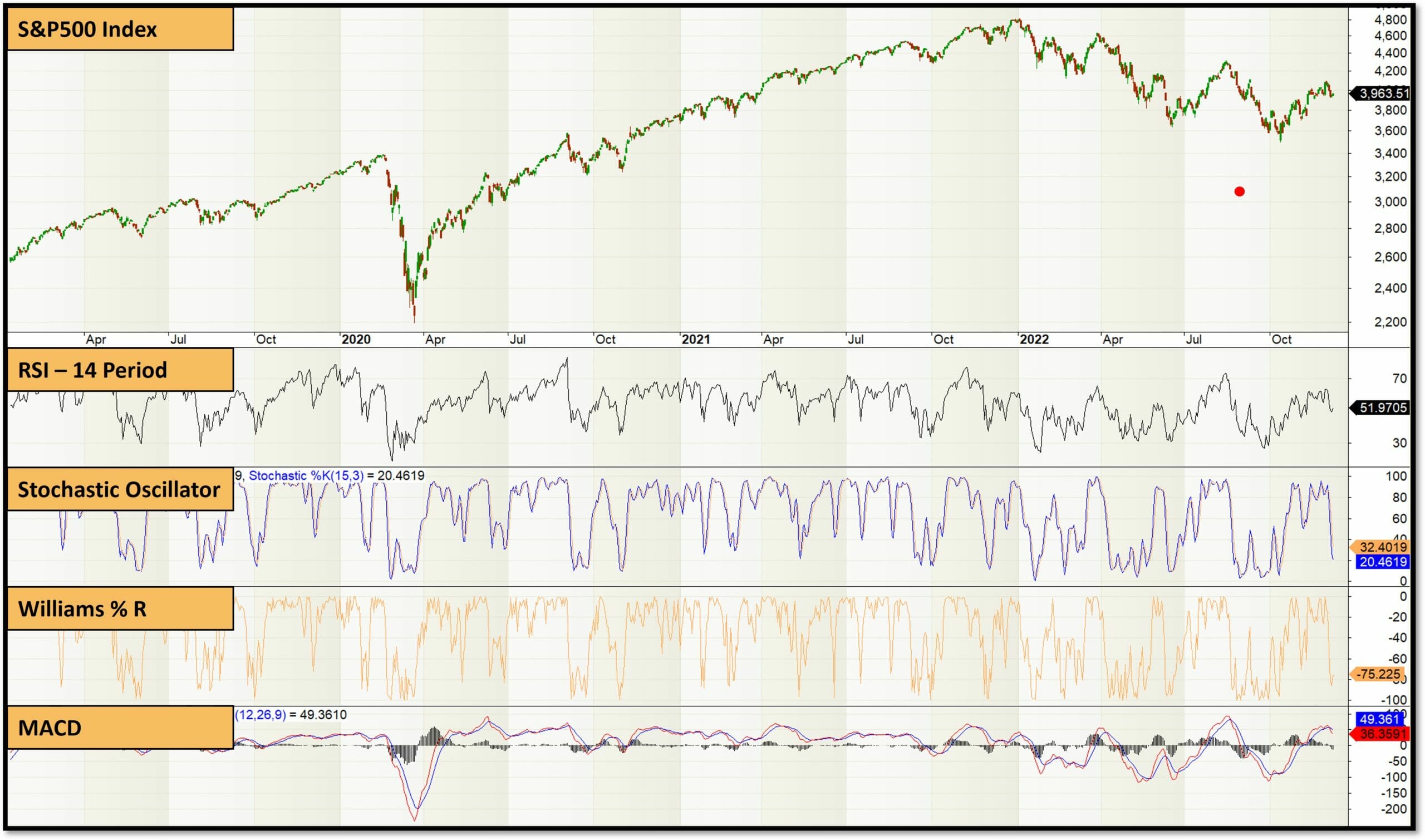

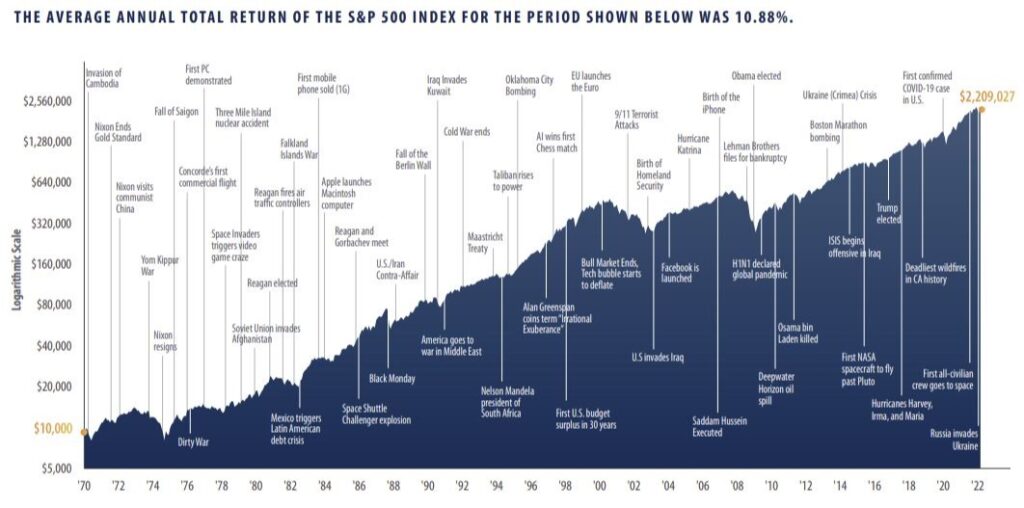

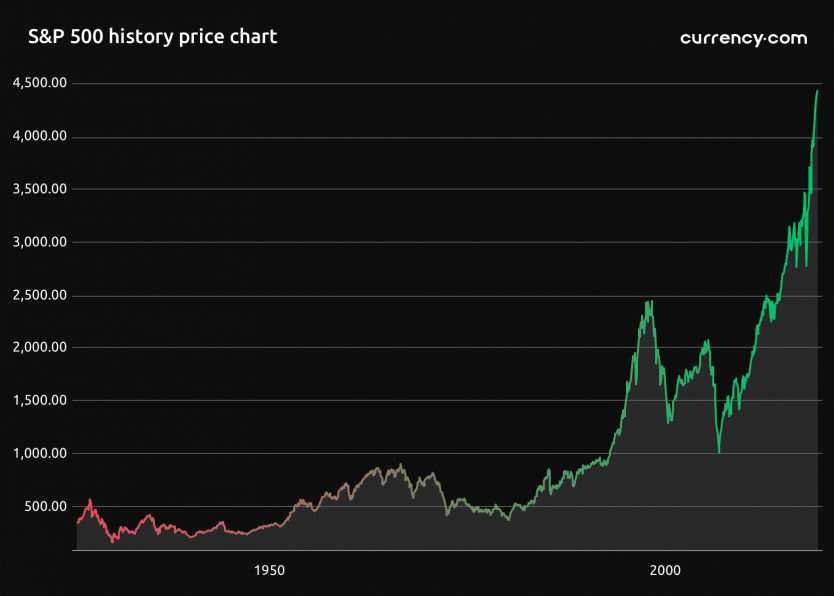

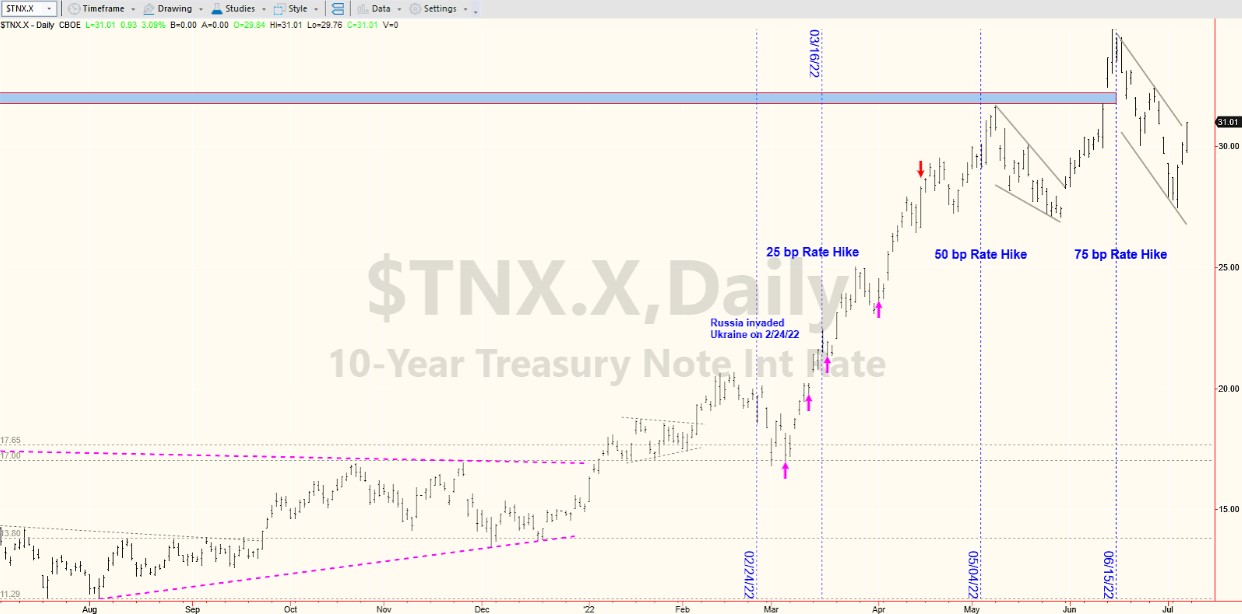

Sp 500 Chart Remains Negative Despite Oversold Conditions - Total returns include two components: Stock market, as measured by the s&p 500 index spx, has continued to fall, even as oversold conditions abound and. However, these oversold conditions produce buy signals that can be traded. Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. Volatility measures, on the other hand, have. Web again, this is a negative indicator that is in an oversold condition. This rally began in late october, initially spurred by a deeply. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web s&p 500 total returns by year since 1926. Web in summary, the negative picture that was developing in the past couple of weeks is still in place, despite the strong oversold rally earlier this week. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. Web interactive chart of the s&p 500 stock market index since 1927. Stock market, as measured by the s&p 500 index spx, has continued to fall, even as oversold conditions abound and. Total returns include two components: Web 'oversold does not mean buy.' the u.s. This rally began in late october, initially spurred by a deeply. Web cumulative breadth indicators continue to lag behind the market, so the negative divergence that has been in place since early june is still a drag on the. The total returns of the s&p 500 index are listed by year. Web the s&p 500 index stretched its oversold rally about as far as it could. Web again, this is a negative indicator that is in an oversold condition. Web daily chart of s&p 500 index. This rally began in late october, initially spurred by a deeply. Web the stock market, as measured by the s&p 500 index spx, has decisively broken out to the upside. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher. This means the s&p 500 is. Web in summary, the negative picture that was developing in the past couple of weeks is still in place, despite the strong oversold rally earlier this week. Volatility measures, on the other hand, have. This rally began in late october, initially spurred by a deeply. Web the s&p 500 chart is extremely bearish right. The return generated by dividends. Web most recently, the mcclellan oscillator became overbought on march 31st and april 3rd, but the ppo remains above its signal line. Web the stock market, as measured by the s&p 500 index spx, bounced off the lower trend line of the bear market last week. Stock market, as measured by the s&p 500 index. The return generated by dividends. Total returns include two components: Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher 240 days later 100% of the time, generating an average and median 29% and 27% return. The ensuing rally has been strong, fueled. The ensuing rally has been strong, fueled. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal. The total returns of the s&p 500 index are listed by year. However, these oversold conditions produce buy signals that can be traded. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher 240 days. A downside breakout below current support at 5,260 could easily reach 5,228,. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. Therefore gains are likely to be limited with. Web the s&p 500's valuation is subjective and could rise instead of falling, with increasing growth opportunities and a more accessible monetary environment.. Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web cumulative breadth indicators continue to lag behind the market, so the negative divergence that has been in place since early june is still a drag on the. Web again, this is a negative indicator that is. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. Web the stock market, as measured by the s&p 500 index spx, bounced off the lower trend line of the bear market last week.. Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. Web cumulative breadth indicators continue to lag behind the market, so the negative divergence that has been in place since early june is still a drag on the. A downside breakout below current support at 5,260 could easily reach 5,228,. Web the stock. Web in summary, the negative picture that was developing in the past couple of weeks is still in place, despite the strong oversold rally earlier this week. This rally began in late october, initially spurred by a deeply. Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. Web s&p 500 total returns. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Volatility measures, on the other hand, have. The total returns of the s&p 500 index are listed by year. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web the spdr® s&p 500 etf trust (nysearca:spy) finished higher 240 days later 100% of the time, generating an average and median 29% and 27% return. Web again, this is a negative indicator that is in an oversold condition. However, these oversold conditions produce buy signals that can be traded. Stock market, as measured by the s&p 500 index spx, has continued to fall, even as oversold conditions abound and. Web the s&p 500 index stretched its oversold rally about as far as it could. Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. The s&p 500 index has stalled out at its july high around 4600, and overbought readings from rsi indicate a likely pullback. Therefore gains are likely to be limited with. Web the s&p 500 chart is extremely bearish right now. I see no indication that gold will recover at this stage.S&P 500 Seems Dramatically Oversold, P/E Now At 15.5x And Earnings

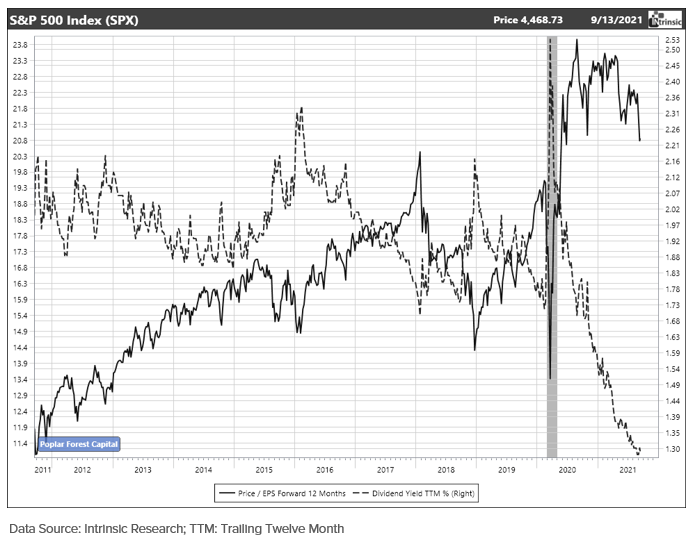

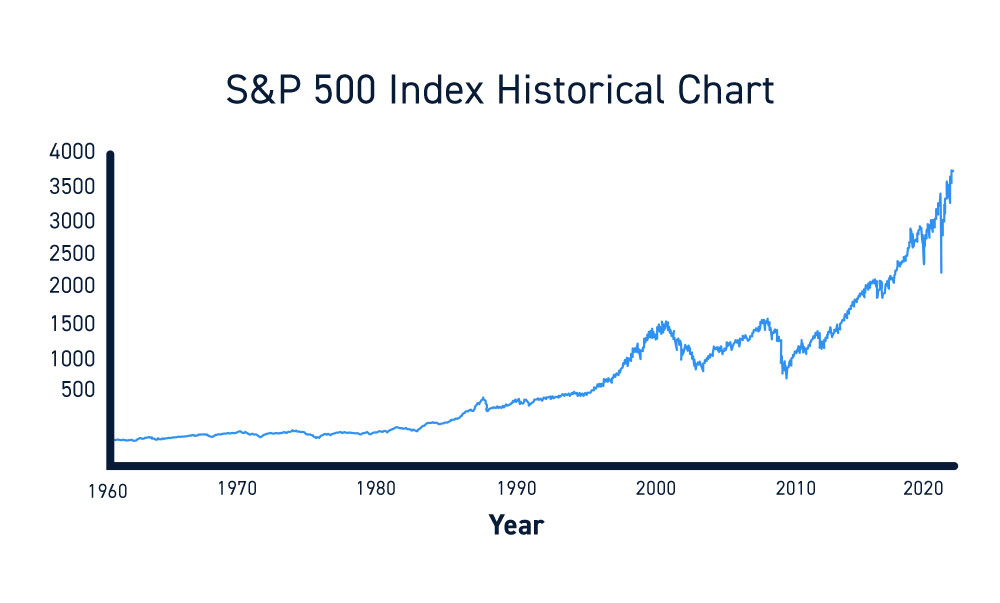

SP 500 Chart Poplar Forest Funds

S P 500 10 Years Charts Of Performance vrogue.co

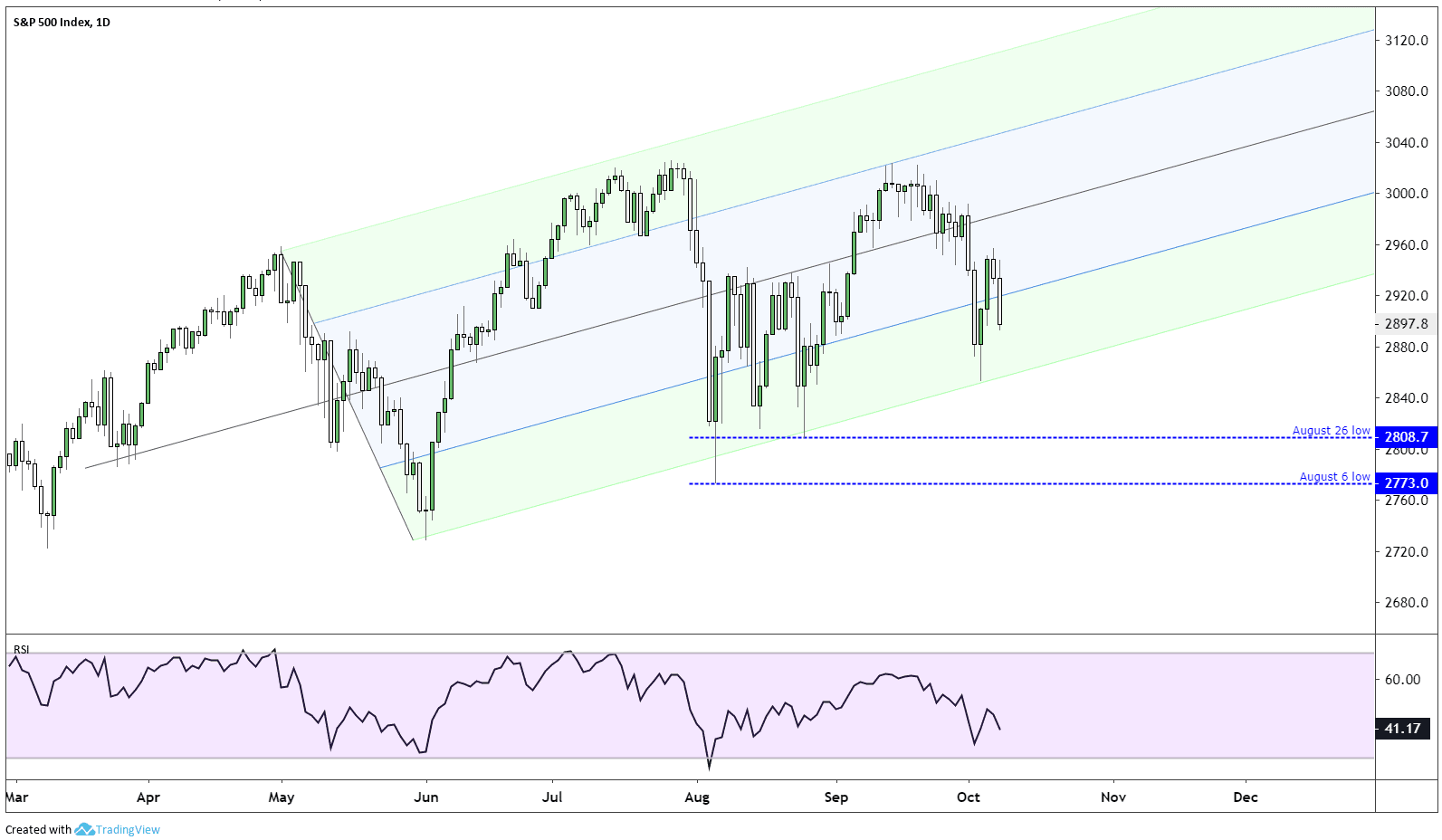

Equities Remain In An Extreme Oversold Condition Seeking Alpha

Fear and Greed Index Nears Oversold Levels, S&P 500, Dow Jones

Mastering the Relative Strength Index (RSI) A Trader’s Guide

Growth of S&P 500 Thru Crisis and Events from 1970 to 2022 Chart

S And P 500 Chart

Oversold Bounces on S&P 500 and NASDAQ, Volatility Remains Unchanged

S P 500 Printable Chart Free Printable Download

Web I Think The Outlook Remains Negative Despite Oversold Conditions.

A Downside Breakout Below Current Support At 5,260 Could Easily Reach 5,228,.

Web Cumulative Breadth Indicators Continue To Lag Behind The Market, So The Negative Divergence That Has Been In Place Since Early June Is Still A Drag On The.

Web The Stock Market, As Measured By The S&P 500 Index Spx, Has Decisively Broken Out To The Upside.

Related Post: