Windfall Elimination Chart

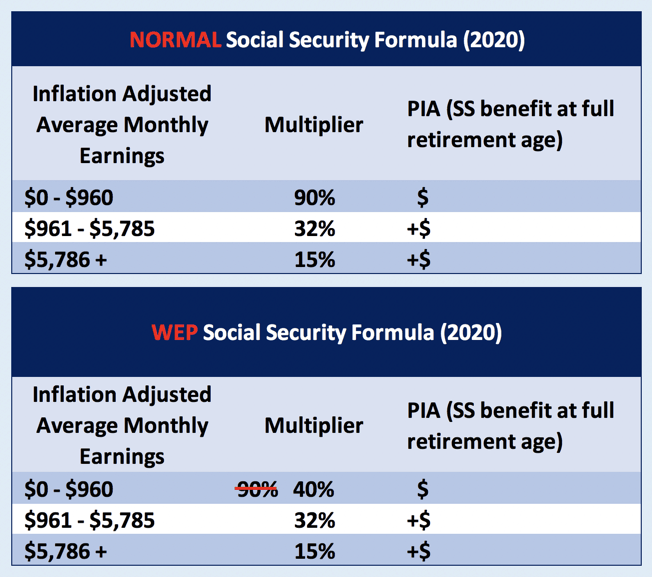

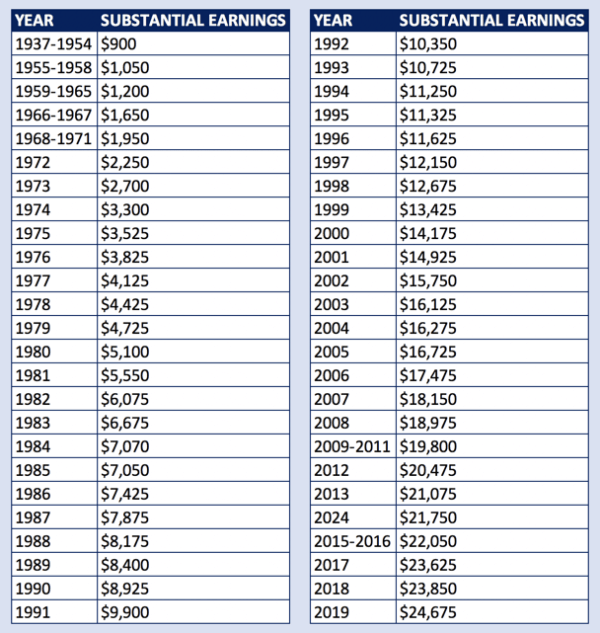

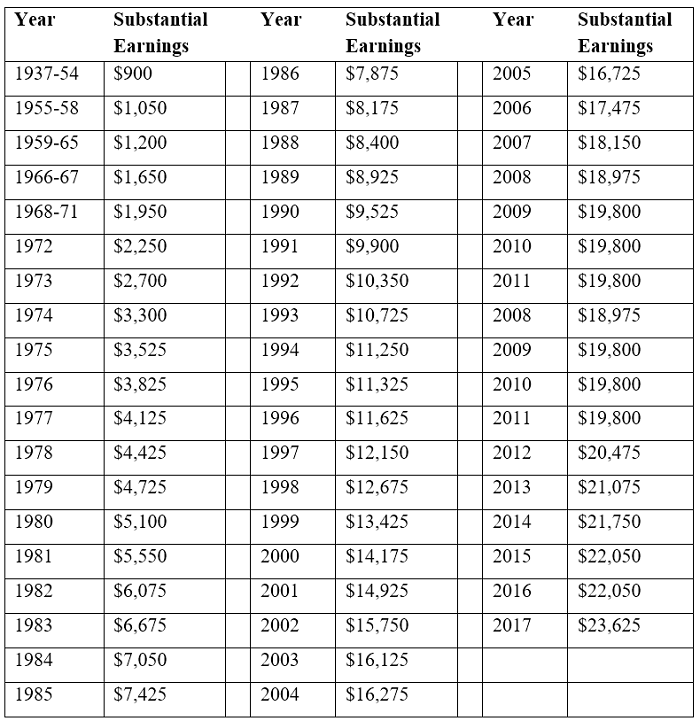

Windfall Elimination Chart - For example, if you have 25 substantial years of earnings your social security monthly payment will be reduced by $223. The 90% factor is reduced as outlined below. Although it’s not widely known, the annual social security benefit estimate does not include the wep penalty in. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the first bend point. Web your social security benefit might be reduced if you get a pension from an employer who wasn’t required to withhold social security taxes. Web see the chart below. If you work for an employer who doesn’t withhold social security taxes from your salary, any retirement or disability pension you get from that work can reduce your social security benefits. Web jan 9, 2023,11:18am est. Use the wep online calculator to calculate your estimated retirement or disability benefits. There is much discussion as to whether the social security windfall. Government pension offset (gpo) when you are entitled to a retirement benefit from a job where you did not pay into social security, your social security spouse or widoe(er) benefit is offset. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the first bend point. Web jan 9, 2023,11:18am est. It most commonly affects government work or work in. Web see the chart below. There is much discussion as to whether the social security windfall. Web the windfall elimination provision (wep) can affect how social security calculates your retirement or disability benefit. Web you can find a table that lists the amount of substantial earnings for each year at the bottom of the second page of our windfall elimination provision fact sheet. Here’s what you need to know about both and how it might affect your social security payments. It often affects public service workers who have “mixed” earnings, or working careers in which some of their jobs paid social security taxes while other positions might not have. Web repealing the wep with a new formula should help ease the difficulty that individuals with noncovered pensions face when planning for retirement. Web the windfall elimination provision affects both social security and disability benefits. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the first bend. Wep reductions are applied on a sliding scale. Web to learn more about the wep and to view the wep chart, visit windfall elimination provision on the social security administration website. Web the windfall elimination provision (wep) and the government pension offset (gpo) are two separate provisions that reduce regular social security benefits for workers and their eligible family members. The normal social security calculation formula is substituted with a new calculation that results in a lower benefit amount. What is it and is it fair? Use our wep online calculator or download our detailed calculator to get an estimate of your benefits. Web jan 9, 2023,11:18am est. Web the following chart shows the wep reduction in 2021 for 20. Web you can find a table that lists the amount of substantial earnings for each year at the bottom of the second page of our windfall elimination provision fact sheet. You will need to enter all your earnings taxed by social security into the wep online calculator manually. Here’s what you need to know about both and how it might. Exceptions to the windfall elimination provision Web our windfall elimination provision (wep) online calculator can tell you how your benefits may be affected. There is much discussion as to whether the social security windfall. Web the windfall elimination provision (wep) can affect how social security calculates your retirement or disability benefit. Web but there’s a bill in congress, which has. Government pension offset (gpo) when you are entitled to a retirement benefit from a job where you did not pay into social security, your social security spouse or widoe(er) benefit is offset. Web look at our wep chart below to see how wep affects social security benefits. It most commonly affects government work or work in. You will need to. Government pension offset (gpo) when you are entitled to a retirement benefit from a job where you did not pay into social security, your social security spouse or widoe(er) benefit is offset. Web jan 9, 2023,11:18am est. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the. Web the windfall elimination provision (wep) and the government pension offset (gpo) are two separate provisions that reduce regular social security benefits for workers and their eligible family members if the worker receives (or is entitled to) a pension based on earnings from employment not covered by social security. Government pension offset (gpo) when you are entitled to a retirement. What is it and is it fair? Web the windfall elimination provision (wep) is a social security rule that can impact the amount of benefits you receive. If you get a low pension you are protected. Web the windfall elimination provision (wep) can affect how social security calculates your retirement or disability benefit. The wep is simply an alternate formula. Web look at our wep chart below to see how wep affects social security benefits. What is it and is it fair? Web the windfall elimination provision affects both social security and disability benefits. Government pension offset (gpo) when you are entitled to a retirement benefit from a job where you did not pay into social security, your social security. Web the windfall elimination provision (wep) and the government pension offset (gpo) are two separate provisions that reduce regular social security benefits for workers and their eligible family members if the worker receives (or is entitled to) a pension based on earnings from employment not covered by social security. Web to learn more about the wep and to view the wep chart, visit windfall elimination provision on the social security administration website. Although it’s not widely known, the annual social security benefit estimate does not include the wep penalty in. Web how much can the windfall elimination provision reduce my social security benefits? Web the following chart shows the wep reduction in 2021 for 20 or less substantial years and for each substantial year up to 30. Web your social security benefit might be reduced if you get a pension from an employer who wasn’t required to withhold social security taxes. Exceptions to the windfall elimination provision Exceptions are also made if you have “substantial” earnings in 21 to 29 years. It often affects public service workers who have “mixed” earnings, or working careers in which some of their jobs paid social security taxes while other positions might not have. Web the windfall elimination provision is designed to calculate her social security benefit as if she is a high earner at $125,000 all in the social security system. You will need to enter all your earnings taxed by social security into the wep online calculator manually. The 90% factor is reduced as outlined below. Web repealing the wep with a new formula should help ease the difficulty that individuals with noncovered pensions face when planning for retirement. After you determine the number of years of substantial earnings you have (as outlined above) you can determine the percentage used in the first bend point. Here’s what you need to know about both and how it might affect your social security payments. Government pension offset (gpo) when you are entitled to a retirement benefit from a job where you did not pay into social security, your social security spouse or widoe(er) benefit is offset.Firefighter Pensions and Social Security How to reduce or eliminate

Windfall Elimination Provision Substantial Earnings Chart Reviews Of

Peabody Council on Aging Resource Library Social Security Windfall

Peabody Council on Aging Resource Library Social Security Windfall

Windfall Elimination Provision (How To Reduce It) YouTube

The Best Explanation of the Windfall Elimination Provision (2023 Update

The Best Explanation of the Windfall Elimination Provision (2021 Update

How To Eliminate The Windfall Elimination Provision

Windfall Elimination Program (WEP) 2018 Social Security Retirement Guide

Windfall Elimination Provison

Web Jan 9, 2023,11:18Am Est.

There Is Much Discussion As To Whether The Social Security Windfall.

Web Congress Enacted And President Reagan Signed Into Law On April 21, 1983, The Windfall Elimination Provision (Wep) To Mitigate This Potential Windfall.

Web The Windfall Elimination Provision (Wep) Can Affect How Social Security Calculates Your Retirement Or Disability Benefit.

Related Post: